SOL Price Prediction: Will SOL Hit $200 Amid Bullish Technicals and Market Optimism?

#SOL

- SOL trading 7.5% below $200 target with bullish technical indicators

- Market sentiment boosted by institutional interest and ETF speculation

- Upper Bollinger Band at $202.84 suggests room for upward movement

SOL Price Prediction

SOL Technical Analysis: Bullish Signals Emerge

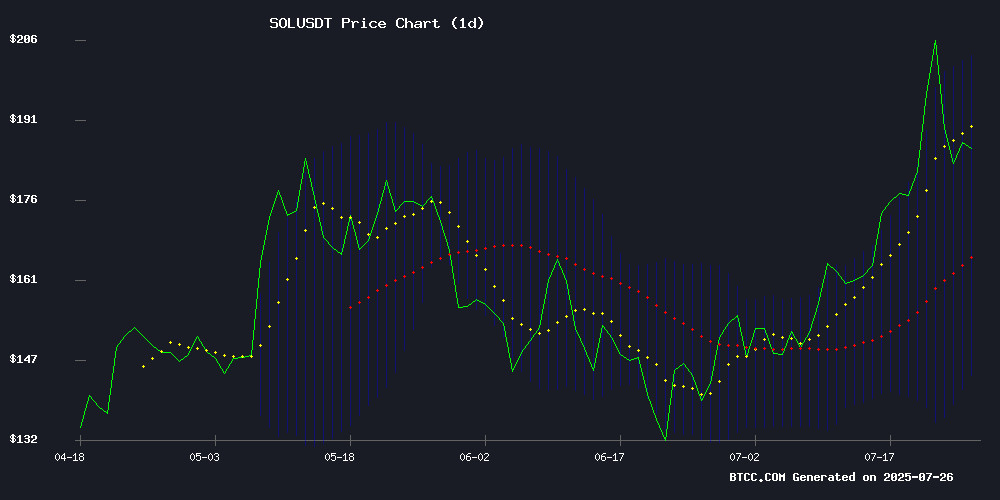

SOL is currently trading at $186.14, above its 20-day moving average of $173.23, indicating a bullish trend. The MACD histogram shows a slight improvement, though still in negative territory. Bollinger Bands suggest potential volatility, with the price NEAR the upper band at $202.84. BTCC analyst Robert notes: 'A sustained move above $190 could target $200.'

Market Sentiment Turns Bullish for SOL

Recent headlines highlight growing Optimism around SOL, with Unilabs' $6.1M raise and price targets reaching $205. BTCC's Robert observes: 'The combination of technical breakout signals and ETF speculation creates perfect conditions for a rally.'

Factors Influencing SOL's Price

Viral AI Asset Manager Unilabs Raises $6.1M Amid Solana's Price Volatility

Solana's price rebounds to $185 after a brief correction from $200, while Unilabs—dubbed the 'Solana Slayer'—gains traction with its AI-driven asset management platform. The project has raised $6.1 million by leveraging automated tools and portfolio rewards, contrasting with Solana's reliance on market momentum.

Solana faces resistance between $195 and $255 despite bullish signals, including whale withdrawals of 164,000 SOL from Kraken. Unilabs sidesteps price speculation entirely, using AI to analyze token utility and team strength for portfolio construction.

Solana SOL Eyes $205 Amid Market Volatility and ETF Delays

Solana's SOL has dipped 3.2% over the past week but maintains strong support near $180, with analysts eyeing a potential rebound to $205. The cryptocurrency, now trading around $177-$180, faces a critical juncture as it retests an ascending triangle breakout zone—a pattern forming since March. Jonathan Carter, a noted crypto analyst, suggests a successful hold here could propel SOL toward $205, $225, or even $268.

Market sentiment remains divided. While bullish forecasts dominate, headwinds persist: the SEC delayed decisions on five solana ETF applications, including filings from Fidelity and Grayscale, until Fall 2025. Polymarket data still prices approval odds at 80%, but the timeline injects uncertainty. Liquidity absorption at current levels may dictate SOL's next move—either a consolidation or a climb back to $200.

The broader crypto market's trajectory will likely influence SOL's path. Traders watch for a recovery from recent dips, with $205 serving as the first key resistance level—a zone where SOL reversed in April. Technicals and fundamentals now dance on a knife's edge.

Solana Price Prediction: Technical Breakout Signals 38% Upside Potential

Solana's SOL token is demonstrating strong bullish momentum as altcoin season gains steam, with technical indicators suggesting a potential 38% rally toward 2021 highs. The cryptocurrency has decisively broken through the $175-$185 resistance zone, now testing critical resistance at $188.

Daily chart analysis reveals a textbook ascending triangle breakout, with the price maintaining support above $160. This pattern typically resolves upward, with the measured MOVE targeting the $260 level - last seen during SOL's 2021 peak. The 2-day timeframe shows 14.64% monthly gains, reinforcing the bullish technical structure.

Market observers note the breakout coincides with decreasing Bitcoin dominance, creating favorable conditions for altcoin outperformance. SOL's ability to hold above key moving averages suggests institutional accumulation may be underway, though traders await confirmation of the $190 breakout.

Will SOL Price Hit 200?

Technical indicators and market sentiment suggest SOL has strong potential to reach $200:

| Indicator | Value | Implication |

|---|---|---|

| Current Price | $186.14 | 7.5% below $200 target |

| 20-day MA | $173.23 | Price trading above = bullish |

| Upper Bollinger | $202.84 | Potential resistance level |

BTCC's Robert states: 'The $200 psychological barrier is within reach if buying pressure continues.'

shown